Virtual Credit Cards: How Do They Work and Are They Safe?

The following article is offered for informational purposes only, and is not intended to provide, and should not be relied on, for legal or financial advice. Please consult your own legal or accounting advisors if you have questions on this topic.

For businesses managing multiple employees, expenses, and vendors, keeping payment methods secure is more important than ever. A virtual credit card offers a modern solution, with more flexibility, control, and added layers of security than traditional cards.

This guide will walk you through what virtual credit cards are, how they work, and whether they’re safe for business use. We’ll also explore how companies like Flex make it easier for businesses to issue unlimited cards to their teams without the usual risks tied to physical credit cards.

What is a Virtual Credit Card?

A virtual credit card is a digital version of a traditional payment card. Instead of a physical card, you receive a unique 16-digit card number, expiration date, and CVV that can be used for online purchases or vendor payments.

Key features include:

- Instantly generated card information: Your organization’s banking or spend management platform typically autogenerates this.

- Limited transaction capabilities: Often only online or digital transactions (i.e., digital wallet transactions) can be made with a virtual card, but not physical card swipes/inserts.

- Often linked to a business’s main credit account: This allows for simple, consolidated reporting.

In short: a virtual credit card works just like a regular credit card, but it lives securely on your device instead of in your wallet.

How Do Virtual Credit Cards Work?

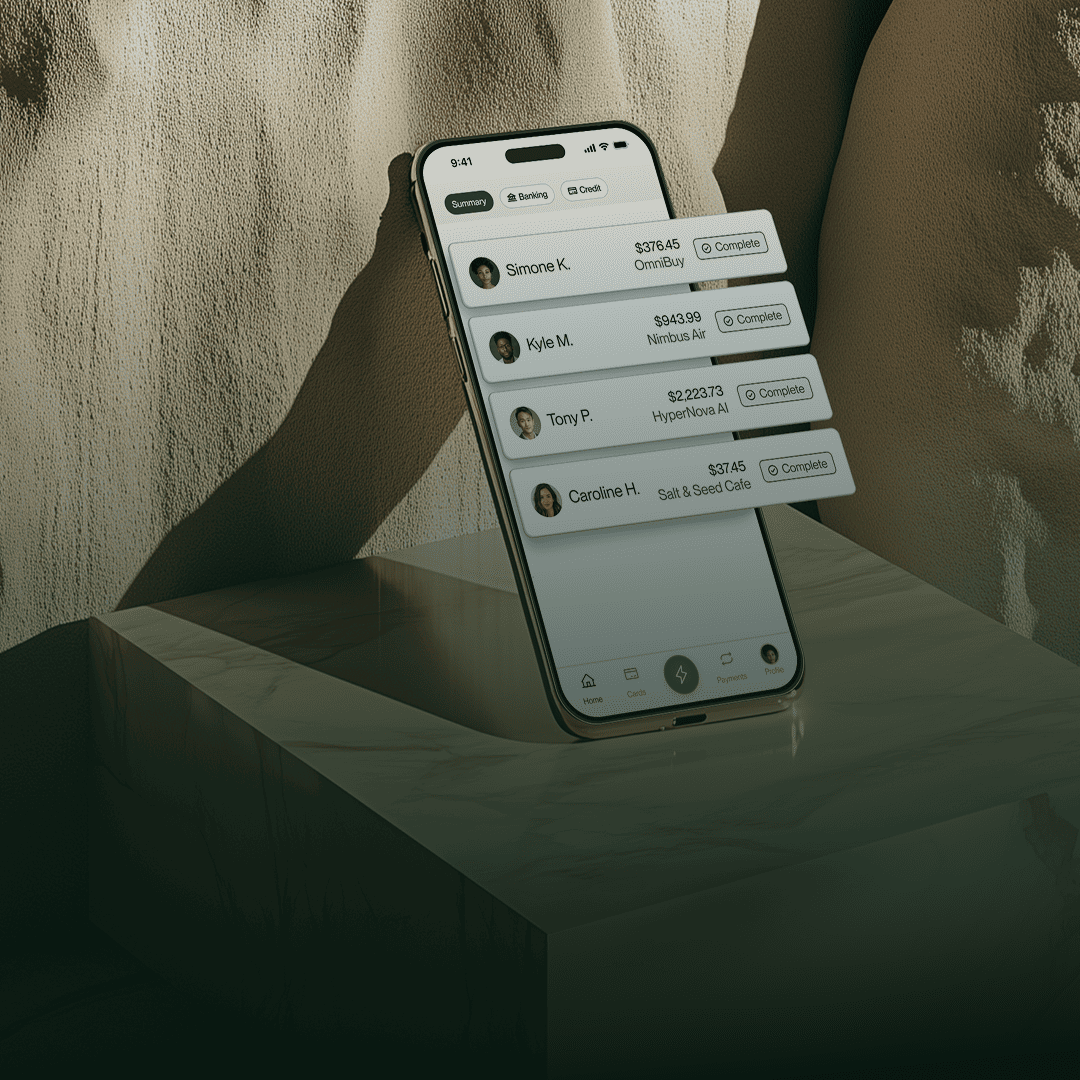

The mechanics of a virtual card are straightforward. Once a virtual card is issued, you can use its unique card details to pay suppliers, vendors, or subscriptions the same way you would with a physical card.

Here’s how the process works:

- Request or generate a card through your financial platform (e.g., Flex).

- Assign it to a specific employee or vendor for controlled spending.

- Set limits or expiration dates for security and budgeting.

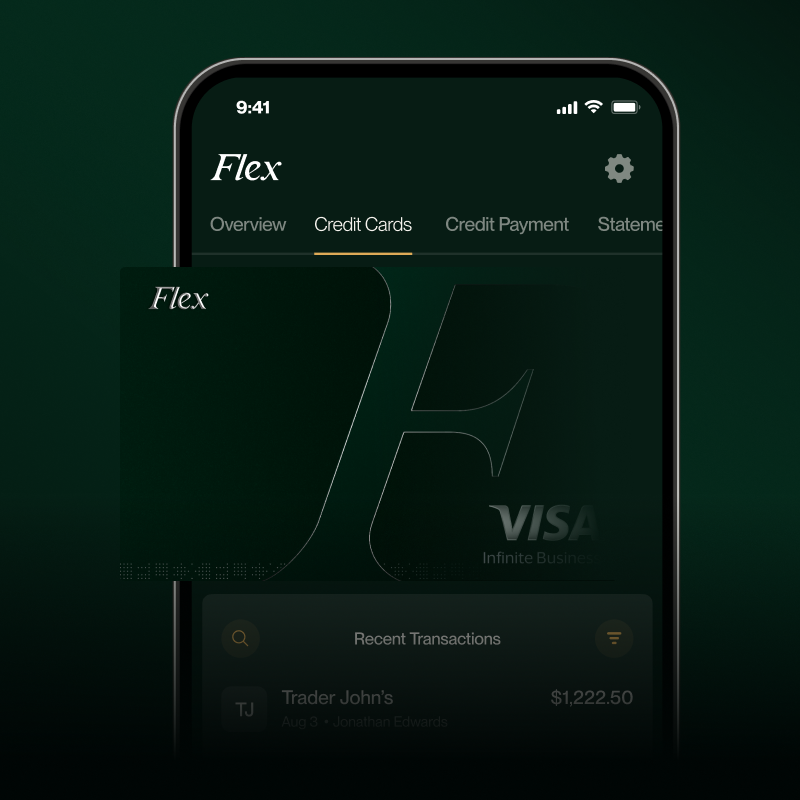

- Track expenses in real-time through your platform’s dashboard.

This setup makes it simple for businesses to manage distributed teams or recurring payments while minimizing fraud risk. With Flex’s automated employee expense management capabilities, businesses are able to issue unlimited virtual cards and keep track of each card and its expenses on our all-in-one platform.

Are Virtual Credit Cards Safe?

The biggest question business owners ask is: are virtual credit cards safe? The answer is yes, they’re often safer than traditional physical cards.

Here’s why:

- Unique card numbers: Each virtual card has its own number connected to the overall account, reducing the overall risk.

- Masked account information: Temporary, unique numbers are generated for every individual transaction, adding an additional layer of security.

- Customizable limits: Organizations can set spending caps and expiration dates to limit potential misuse for each virtual card.

- Vendor-specific usage: Cards can be locked for use at a single merchant, making spending outside of that nearly impossible.

- No physical card: Without plastic or metal, there’s no risk of skimming or theft — if fraud is detected, the card number is simply deactivated and a new number is issued immediately.

These protections can give business owners peace of mind, especially when employees need access to company funds.

Virtual Credit Cards vs. Physical Credit Cards

Here’s a quick side-by-side look at how virtual credit cards compare to traditional ones:

Why Businesses Use Virtual Credit Cards

Virtual cards have grown in popularity among modern businesses because they streamline spending without sacrificing control.

Benefits for Businesses

- Expense control: Assign different cards for subscriptions, vendors, and departments.

- Simplified accounting: Easy tracking of payments through expense management platforms like Flex.

- Employee empowerment: Issue cards instantly to team members without waiting for a bank.

- Scalability: Generate unlimited cards as your business grows.

Why Flex is a Strong Choice for Virtual Credit Cards

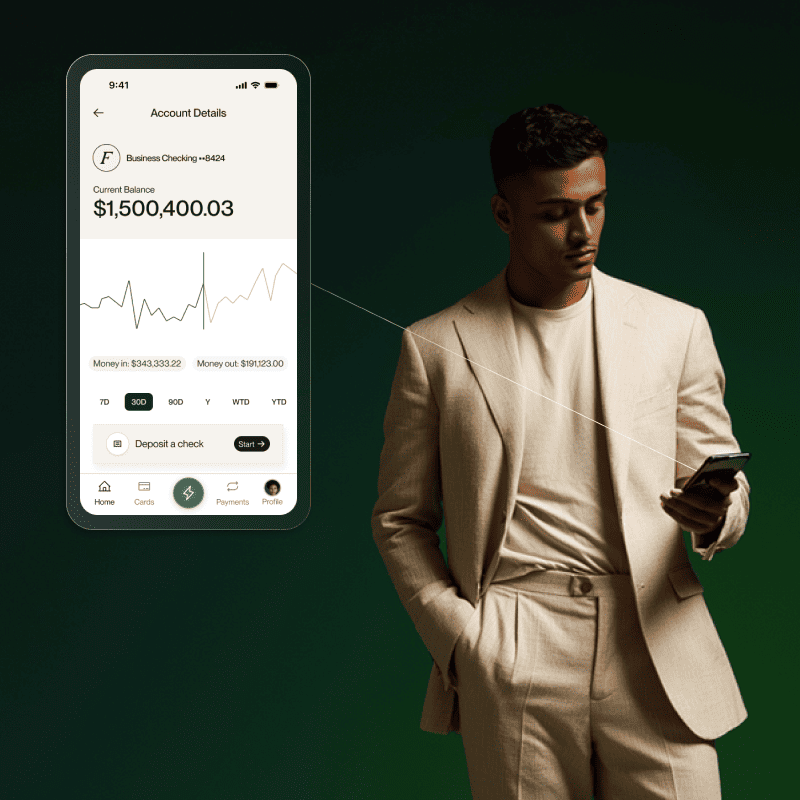

While many banks now offer digital payment options, Flex stands out with its unlimited virtual card offering. Businesses can generate as many cards as they need, assign them to employees or vendors, and track all spending from a single platform.

This eliminates bottlenecks in purchasing, helps prevent fraud, and ensures your business always stays in control of its finances.

How to Get a Virtual Credit Card

If you’re wondering how to get a virtual credit card, the process depends on your financial provider. Many banks and spend management platforms offer them, though flexibility varies.

With Flex, businesses can:

- Generate unlimited virtual cards instantly from the Flex all-in-one platform

- Assign cards to employees or vendors with customizable controls

- Manage expenses in one place with real-time reporting and payment tracking

This makes Flex’s solution ideal for businesses with fast-scaling teams or complex vendor relationships.

How to Use a Virtual Credit Card

Once issued, a virtual card is used just like a traditional one: enter the card number, expiration date, and CVV when making a purchase online.

Businesses often use them for:

- Recurring software subscriptions (assigning one card per vendor)

- Employee purchases (such as travel or equipment)

- Vendor or supplier payments

- One-time purchases (with disposable card numbers)

By segmenting expenses this way, companies gain greater visibility and control over how money is spent.

Final Thoughts

Virtual credit cards aren’t just a convenience; they’re often a safer, smarter way for businesses to manage spending. From security benefits to real-time expense tracking, they provide an edge over traditional physical cards.

For businesses looking to scale without compromising control, unlimited virtual cards through Flex make it easy to empower employees, streamline payments, and protect company funds.

©2025 Flexbase Technologies, Inc., all rights reserved. Flex products may not be available to all customers. See the Flex Terms of Service for details. Terms are subject to change.

.png)

.svg)