What is Tail Spend and Why Does it Matter?

The following article is offered for informational purposes only, and is not intended to provide, and should not be relied on, for legal or financial advice. Please consult your own legal or accounting advisors if you have questions on this topic.

In business procurement, it’s easy to focus on the big-ticket items like major vendor contracts, bulk inventory orders, and long-term service agreements. But tucked away in your company’s budget is another category of spending that can quietly add up: tail spend.

While these purchases may seem too small to make an impact, collectively they can represent a significant portion of your expenses. If left unmanaged, they could mean missed savings opportunities. That’s why understanding and mastering tail spend management can make a big difference to your bottom line.

What is Tail Spend?

In simple terms, tail spend refers to the smaller, often overlooked purchases that don’t fall under your main procurement categories. They might include one-off supplier orders, office supplies, software subscriptions, or last-minute purchases from vendors you don’t typically use.

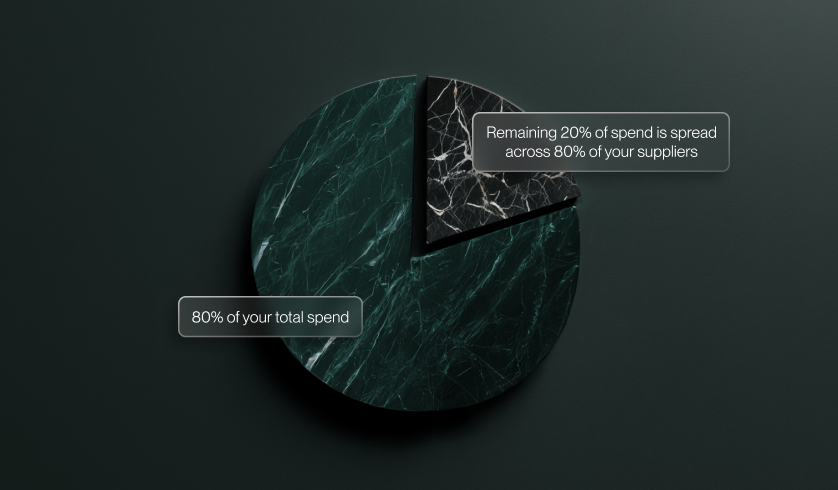

Often, these expenses make up about 20% of your total spending but can involve up to 80% of your suppliers — which is why they’re called “tail” spend. They’re the long tail, so to speak, of your procurement activities, happening outside the primary supplier relationships your business focuses on.

Examples of Tail Spend Purchases

Common types of tail spend include:

- Office equipment or supplies bought from retail stores

- Emergency equipment or office repair services

- Small software licenses purchased with a company card

- Travel expenses booked outside approved channels

- Marketing materials ordered from one-off vendors

- Unplanned maintenance work

- One-off gifts to customers or employees

Individually, these transactions seem minor, but across an organization, they can add up quickly.

Why Tail Spend Matters

It can be easy to write off tail spend as unimportant because each transaction is small. However, there are several reasons why tail spend deserves attention.

1. Missed Savings Opportunities

Because these purchases often bypass formal procurement processes, you’re likely missing out on volume discounts, negotiated rates, and competitive bidding.

2. Reduced Visibility

When expenses are scattered across multiple suppliers and employees, it can be harder to see the full picture of company spending — making budgeting and forecasting less accurate.

3. Increased Supplier Management Costs

Managing a large number of small suppliers increases administrative workload and can strain accounts payable processes.

4. Risk of Non-Compliance

If smaller purchases, like the occasional spend on employee cards, go untracked, they may fail to meet internal compliance guidelines or industry regulations, increasing risk exposure.

At Flex, our expense management platform keeps track of all purchases made on company cards, so you don’t have to worry about this higher risk.

The 80/20 Rule and Tail Spend

The Pareto Principle, or 80/20 rule, plays a large role in understanding tail spend. In procurement, it often means:

- 80% of your total spend is concentrated within ~20% of your suppliers (your primary or preferred vendors).

- The remaining 20% of spend is spread across 80% of your suppliers — this is your tail spend.

That 20% of total spend can be highly inefficient if it’s unmanaged, costing your business both time and money. The challenge? Effective tail spend management.

How to Manage Tail Spend Effectively

Tail spend management is about identifying, tracking, and controlling those smaller purchases so they work in your favor. Here’s how to start:

1. Centralize Purchasing

Use a centralized platform, like Flex, or a procurement system to capture all transactions in one place. This ensures visibility into every purchase, no matter how small.

2. Identify Frequent Low-Value Purchases

Look for repeat purchases across teams — like office supplies or software licenses — that could be consolidated with a preferred vendor.

3. Consolidate Vendors

Reduce the number of one-off suppliers by negotiating with a smaller pool of vendors who can meet most or all of your needs.

4. Implement Purchasing Controls

Set up strong internal controls, including approval workflows for purchases above a certain threshold or outside preferred categories.

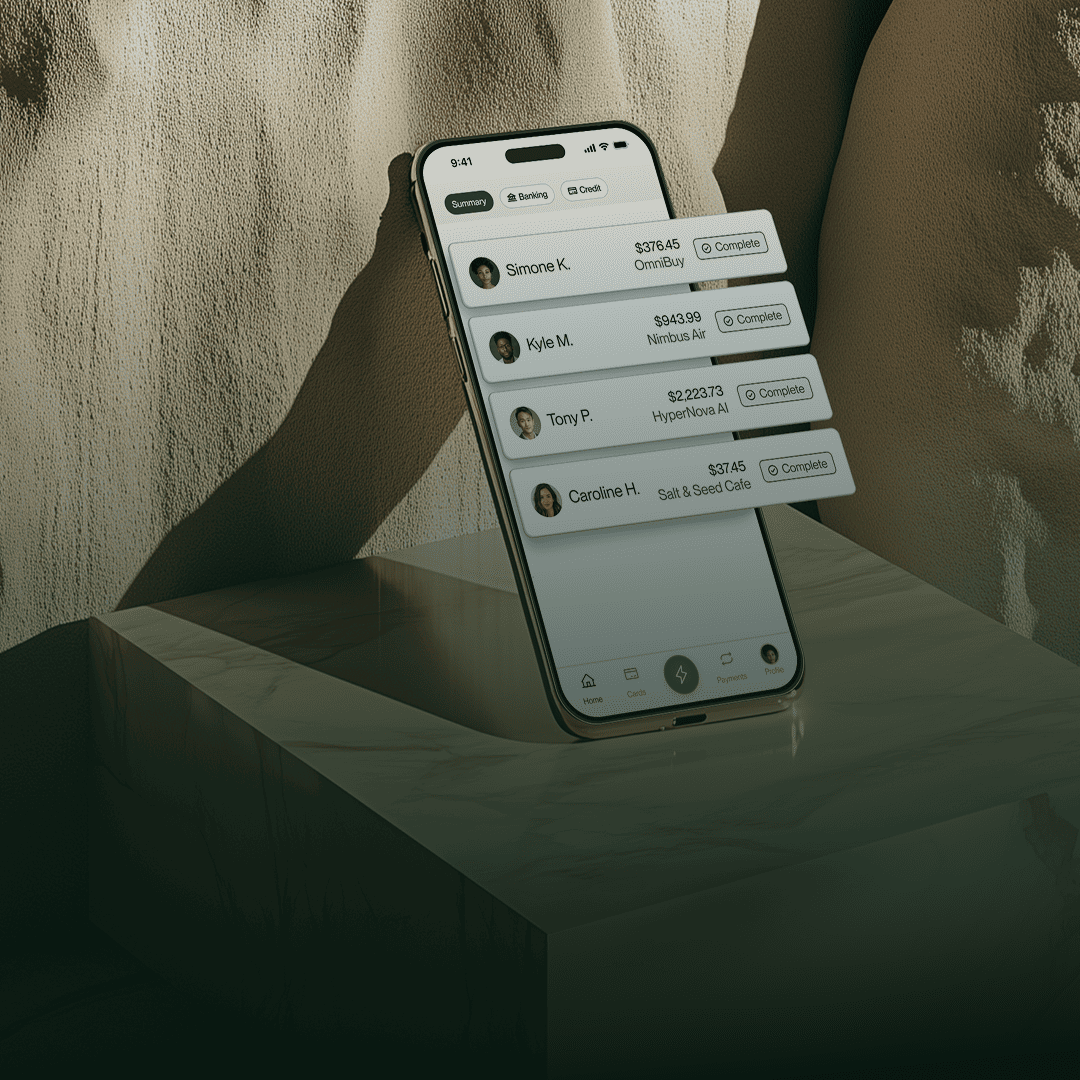

5. Leverage Corporate or Business Credit Cards

Using a dedicated business credit card — like the Flex Business Credit Card — gives you real-time visibility into spend, allows for flexible payment terms, and simplifies expense tracking for tail spend items.

Flex allows you to issue unlimited employee cards, allowing your employees to manage their own purchases while ensuring all spend flows into a centralized, tracked platform.

6. Review and Adjust Regularly

Conduct quarterly reviews to see if your tail spend has shifted, and refine your procurement strategy accordingly.

Potential Savings in Tail Spend Management

Below is an example of how managing tail spend could uncover hidden savings. This table demonstrates how much you could save by implementing an effective tail spend management strategy.

Unmanaged vs. Managed Tail Spend

Here’s a quick comparison of the risks of leaving tail spend unchecked versus the benefits of managing it proactively:

How Flex Can Help with Tail Spend Management

The Flex Business Credit Card makes tail spend management easier by giving you:

- Real-time expense visibility so you know where every dollar goes

- Customizable card controls for different team members

- Up to 60-day float to free up cash flow

- Integrated bill pay to streamline vendor payments

By routing tail spend through Flex, you centralize tracking, improve compliance, and create opportunities to negotiate better rates with vendors.

Final Thoughts

Though tail spend might seem insignificant, ignoring it can lead to unnecessary costs and inefficiencies. By applying the 80/20 rule and using smart tools like Flex, you can turn those “miscellaneous” purchases into a controlled, optimized part of your procurement strategy.

In short, tail spend management isn’t just about cutting costs — it’s about gaining visibility, improving processes, and unlocking savings you didn’t know you had.

Flexbase Technologies, Inc. (Flex) is a financial technology company and is not a bank. The Flex Business Credit Card is issued by Lead Bank, pursuant to a license from Visa U.S.A. Inc. and is only available to eligible commercial entities. Fees and terms and conditions apply. Applicants are subject to eligibility requirements.

Though tail spend might seem insignificant, ignoring it can lead to unnecessary costs and inefficiencies. By applying the 80/20 rule and using smart tools like Flex, you can turn those “miscellaneous” purchases into a controlled, optimized part of your procurement strategy.

In short, tail spend management isn’t just about cutting costs — it’s about gaining visibility, improving processes, and unlocking savings you didn’t know you had.

.svg)