What Are Liquid Assets?

The following article is offered for informational purposes only, and is not intended to provide, and should not be relied on, for legal or financial advice. Please consult your own legal or accounting advisors if you have questions on this topic.

What Are Liquid Assets?

Every business needs cash — whether you’re a startup or an established enterprise organization. However, if you don’t have cash, there is another option that will help keep you solvent. Enter: liquid assets, or the cash and cash-like resources your business can access quickly.

They’re essential for paying bills, covering payroll, and responding to unexpected costs or opportunities. If your company doesn’t have enough liquid assets, even strong sales or valuable long-term assets won’t help in a pinch.

In this article, we’ll explain what liquid assets are, why they matter, and how to calculate them. Plus, you’ll learn the difference between liquid and non-liquid assets, how liquidity impacts your business, and what to track to maintain financial stability.

What Is Liquidity?

Before diving into the details of liquid assets, it’s important to understand what liquidity is overall. Liquidity refers to how quickly and easily an asset can be converted into cash without significantly affecting its value.

The more liquid, or convertible, an asset is, the faster and more reliably it can be turned into cash to cover expenses, fund investments, or respond to emergencies. Cash itself is the most liquid, while assets like real estate or equipment are not, due to the time and effort required to sell them.

Liquid Assets Definition

So, what are liquid assets? Simply put, liquid assets are cash or other assets that can be quickly and easily converted into cash. They’re vital for ensuring your business can cover short-term liabilities and maintain operational continuity.

To be considered a liquid asset, something must meet these criteria:

- It can be converted into cash quickly (typically within 90 days)

- It retains its value during the conversion process

- It has a ready market of buyers

Non-liquid assets, also called illiquid, are things that cannot be easily converted into cash. For example, real estate, vehicles, art, and retirement accounts would not be considered liquid assets due to the amount of time it would take to actually have the cash value of those items in hand.

Examples of Liquid Assets

To help clarify what qualifies, here are some common liquid asset examples:

- Cash

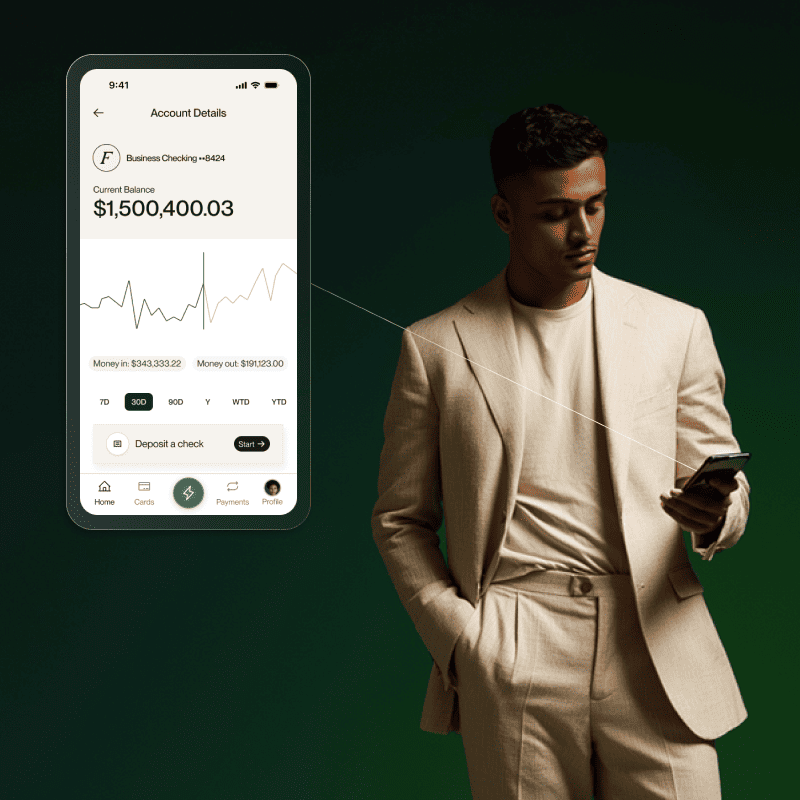

- Funds in checking and savings accounts

- Money market accounts

- Certificates of deposit (short-term)

- Marketable securities like stocks, bonds, mutual funds

- Accounts receivable (if collectible within 90 days)

These assets are easy to access and can quickly be used to fund operations or settle debts.

Liquid vs. Non-Liquid Assets

Why Liquid Assets Matter for Your Business

Understanding and maintaining a healthy amount of liquid assets is essential for business success, growth, and scalability. Here’s why:

- Operational Stability: They ensure you can easily cover payroll, rent, supplier invoices, and other day-to-day expenses.

- Emergency Preparedness: Whether it’s a market downturn or a client delay in payment, liquidity helps you respond without taking on additional debt.

- Investment Readiness: Having liquid reserves enables you to act on opportunities quickly — like buying discounted inventory or launching a new product.

How to Calculate Your Business’s Liquid Assets

To calculate where your company is liquidity-wise, you’ll need to tally up all assets that are cash or can be converted to cash quickly.

Here's a simplified formula:

Cash + Marketable Securities + Accounts Receivable (collectible within 90 days) = Liquid Assets

Once calculated, you can compare it to your short-term liabilities in order to understand your liquidity ratio — or your organization’s ability to meet its short-term financial goals.

Best Practices for Managing Liquidity

Managing liquidity isn't just about holding onto cash — it’s about creating balance. Here are some smart strategies:

- Set liquidity targets based on your industry, revenue cycles, and growth goals

- Review aging reports for receivables and follow up on overdue invoices

- Use smart expense management tools (like Flex) to monitor cash flow

- Keep a portion of assets in easily sellable investments for flexibility

- Run cash flow forecasts regularly to plan for upcoming expenses

Final Thoughts

Having a strong understanding of liquid assets helps your business remain flexible, stable, and ready for whatever comes next. By tracking liquidity, optimizing your mix of liquid and non-liquid assets, and using smart tools to monitor performance, you’ll build a more resilient foundation for long-term success.

.png)

.png)

.svg)