- Deferred revenue represents payments received for goods or services that are not yet delivered.

- Accurate tracking of deferred revenue is essential for compliance, forecasting, and investor confidence.

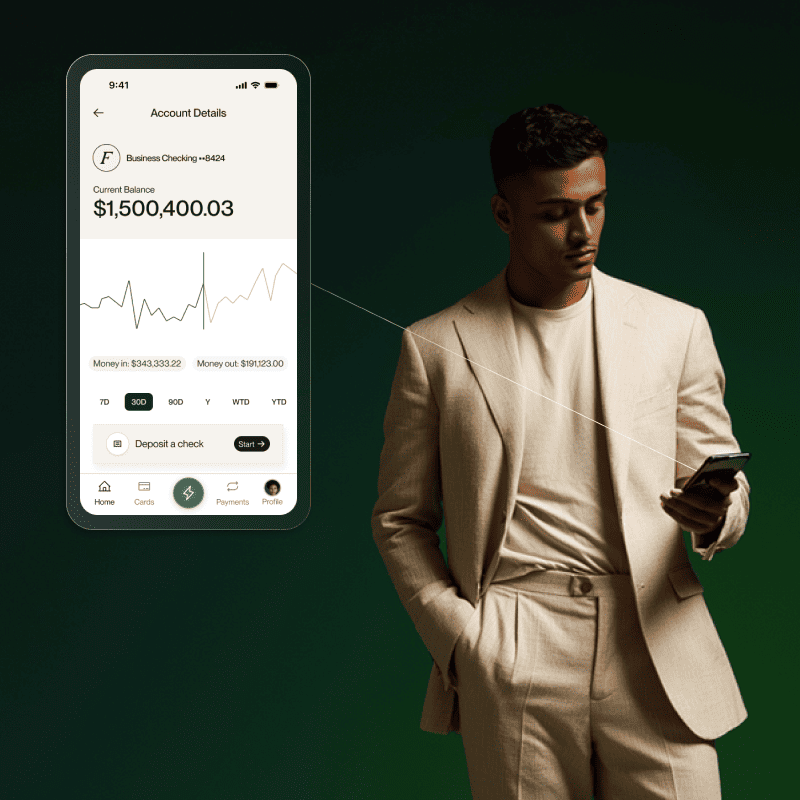

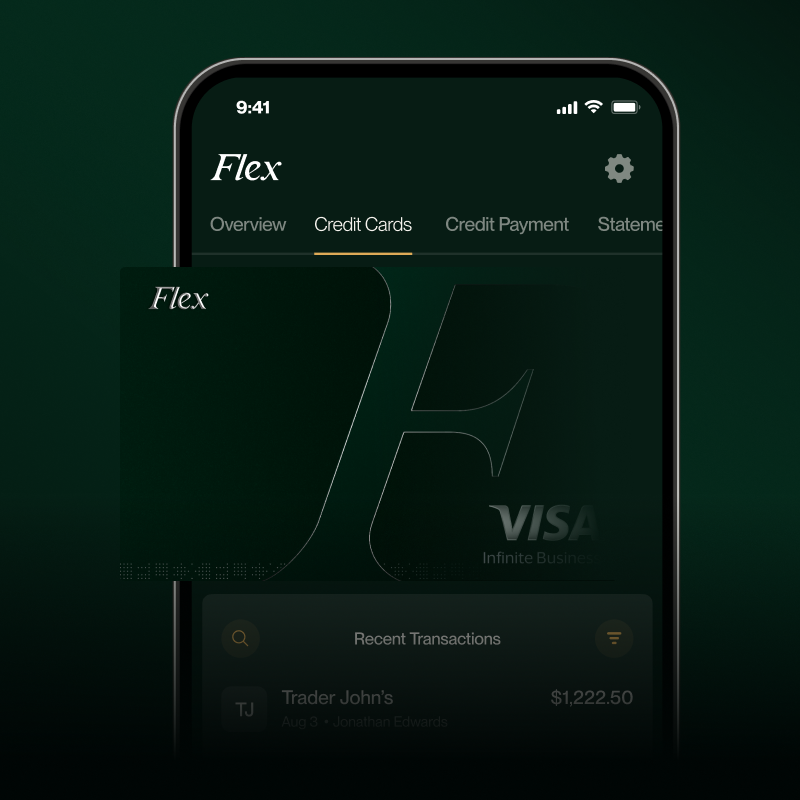

- High-end businesses use advanced financial tools like Flex to turn deferred revenue into strategic foresight.

- Flex enables precise recognition, reporting, and liquidity planning, all within a seamless digital experience.

Mastering Deferred Revenue for Elevated Business Planning

The following article is offered for informational purposes only, and is not intended to provide, and should not be relied on, for legal or financial advice. Please consult your own legal or accounting advisors if you have questions on this topic.

Understanding Deferred Revenue

Deferred revenue, sometimes called unearned revenue, refers to payments a business receives before delivering its goods or services. In accounting terms, it represents a liability, not income, until the obligation is fulfilled.

For instance, when a client prepays for a year-long consulting engagement, the upfront payment can’t be recognized as revenue immediately. Instead, it must be recorded as deferred revenue and gradually recognized over the service period.

This practice ensures financial statements remain transparent and compliant with accrual accounting standards, which are critical for maintaining trust with investors, partners, and auditors.

What Deferred Revenue Means for High-Earning Businesses

For middle-market and high-net-worth businesses, deferred revenue management is a signal of operational excellence.

Businesses at this level often manage complex cash flows, layered service agreements, and long-term contracts. Deferred revenue provides a window into future earnings and operational momentum, influencing strategic decisions like:

- Expansion planning and cash flow optimization

- Investment timing and resource allocation

- Long-term forecasting for board reporting

- Liquidity planning during growth or acquisition cycles

Accurate management of deferred revenue reflects not just fiscal discipline, but sophistication.

Deferred Revenue vs. Accrued Revenue

Understanding the distinction between deferred and accrued revenue helps refine your forecasting models and financial reports.

Deferred Revenue Journal Entry Example

Because deferred revenue can’t technically be recognized fully as revenue, the question becomes: How do you record deferred revenue for your records?

Here’s the standard process for recognizing and releasing deferred revenue over time.

At the time of payment receipt:

- Debit: Cash (asset increases)

- Credit: Deferred Revenue (liability increases)

As services are provided:

- Debit: Deferred Revenue (liability decreases)

- Credit: Revenue (income increases)

Flex’s intelligent accounting tools help automate these transitions, ensuring each recognition event aligns with your delivery milestones, eliminating the risk of manual entry errors or timing discrepancies.

Why Deferred Revenue Matters for Strategic Planning

When managed well, deferred revenue can become a strategic advantage. It often helps leaders look beyond current cash flow and understand future performance potential.

Key benefits include:

- Financial accuracy: Ensures reports reflect earned value over time, not just cash in hand.

- Investor confidence: Transparent revenue recognition supports stronger valuation discussions.

- Predictive forecasting: Deferred revenue data provides insight into customer retention and growth trends.

- Liquidity management: Helps balance capital deployment with future service obligations.

For businesses where precision and discretion are metrics for success, these insights are indispensable.

How Flex Simplifies Deferred Revenue Management

Flex’s suite of financial tools is designed for modern businesses that expect sophistication, not complexity.

Flex tools help you:

- Automate recognition schedules with smart logic that adapts to contract terms.

- Centralize reporting across multiple business entities or revenue streams.

- Forecast with clarity using deferred revenue data as a leading indicator of growth.

- Reduce risk through accurate, real-time tracking of liabilities and receivables.

Unlike legacy systems that require heavy configuration, Flex integrates seamlessly with your existing workflows, offering transparency, control, and elegance in one unified platform.

Deferred revenue management is not just an accounting need. With Flex, it becomes part of a broader strategy that supports smarter decisions, scalable growth, and a refined operational edge.

Final Thoughts

Deferred revenue is more than an accounting concept. It can be a reflection of how well a business understands its own momentum. For discerning leaders, it signals control, foresight, and the ability to transform complexity into clarity.

With Flex, that clarity is built into every transaction, helping your business plan confidently for what’s next while maintaining the financial precision your investors and stakeholders expect.

.png)

.png)

.png)

.svg)