How to Automate Your Accounts Payable With AI

The following article is offered for informational purposes only, and is not intended to provide, and should not be relied on, for legal or financial advice. Please consult your own legal or accounting advisors if you have questions on this topic.

Accounts payable: a very necessary, very tedious part of business operations. Between approval bottlenecks, disparate systems, and manual tasks, many businesses spend far too much time on accounts payable.

The stakes are high since accounts payable demands accuracy. Yet, manual processes open the door to mistakes, whether due to data entry issues or potential fraud.

AI has reshaped traditional accounts payable processes by streamlining and automating workflows. Businesses should consider accounts payable (AP) solutions powered by AI to save time and reduce the risk of error.

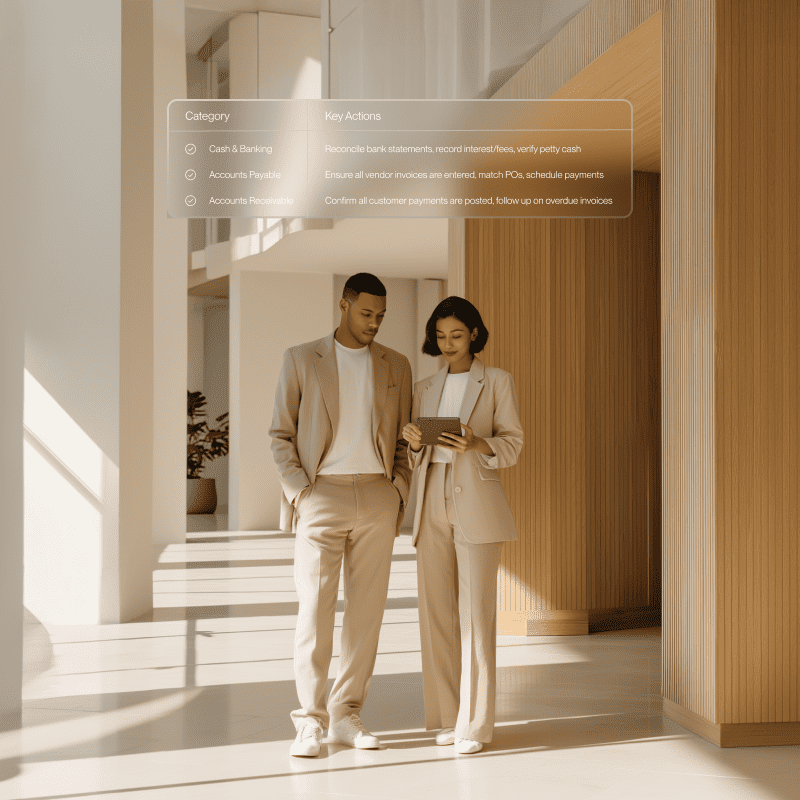

What Is AI-Powered Accounts Payable Automation?

AI-powered accounts payable automation relies on artificial intelligence and machine learning to improve AP processes in various ways. The result is less manual work, increased accuracy, and faster approvals.

Since AI can handle a lot of manual tasks, finance teams can focus on higher-value work and spend less time on tedious data entry.

Key Benefits of Using AI for Accounts Payable

Automating tasks and reducing errors lowers AP costs. Companies can avoid the hard costs that errors might cause, plus increase AP volume without increasing headcount.

Here are some specific ways AI makes the work of AP teams more accurate and efficient.

Eliminate Manual Data Entry

AI can extract data from documents such as PDFs, emails, and paper scans. Using OCR and machine learning, AI extracts data from invoices, purchase orders, receipts, and more.

With AI invoice processing, details like vendor names, invoice numbers, dates, and amounts are automatically entered into an accounts payable system. Without AI, an employee would need to manually enter that information.

Speed Up Approvals and Payments

Many companies have thresholds for approving expenses and specific people who need to approve the purchase. AI can route invoices and employee expenses to the right team member, based on pre-defined rules and expense amounts. This saves time, since the AP team wouldn’t need to email or notify the right person for approval.

Improve Accuracy and Reduce Human Error

Since AI can extract data from documents, it reduces errors that happen when a human manually keys in data. For example, an invoice for $7,295 is received, but someone accidentally enters $7,925 into the system. Additionally, AI improves accuracy by ensuring transactions are properly coded.

AI can also verify extracted data between documents, such as comparing a purchase order to an invoice, saving human review time in two-way and three-way matching.

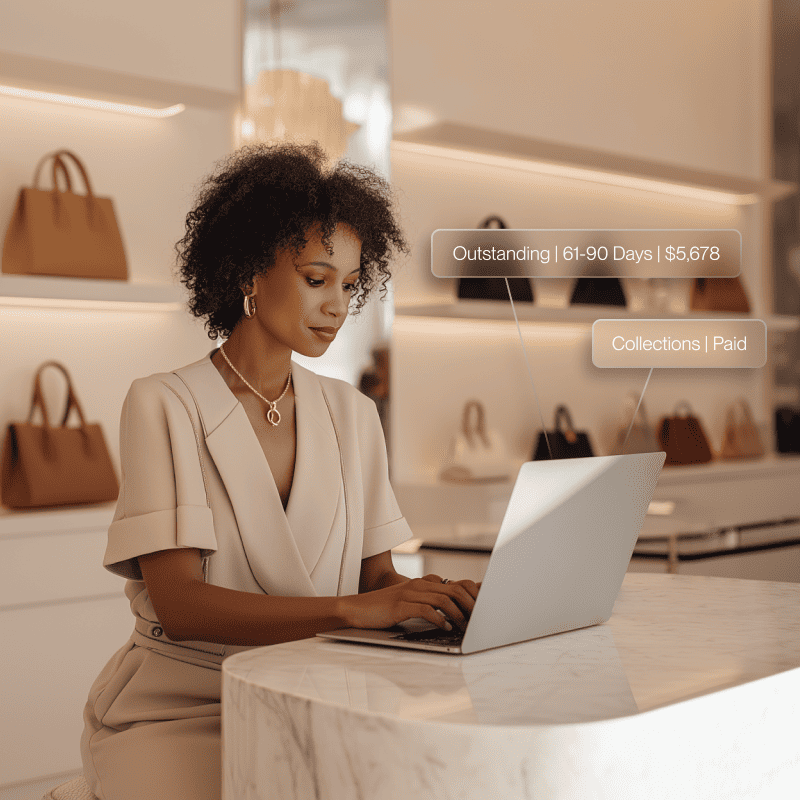

Avoid Incorrect Payments and Avoid Fraud

In addition to data entry errors, small business accounts payable teams might accidentally pay an invoice twice. If a vendor emails and sends a paper copy of an invoice, traditional bill pay software might not catch the duplicate. Errors can also happen when someone remits payment to the wrong vendor by making an incorrect selection in the AP system. These mistakes are avoided because AI can flag duplicates and match invoices with vendors.

Additionally, AP always has a risk of fraud, whether it’s external (such as a fake vendor) or internal (an employee tampering with payments). AI and algorithms can analyze transaction data and identify anomalies.

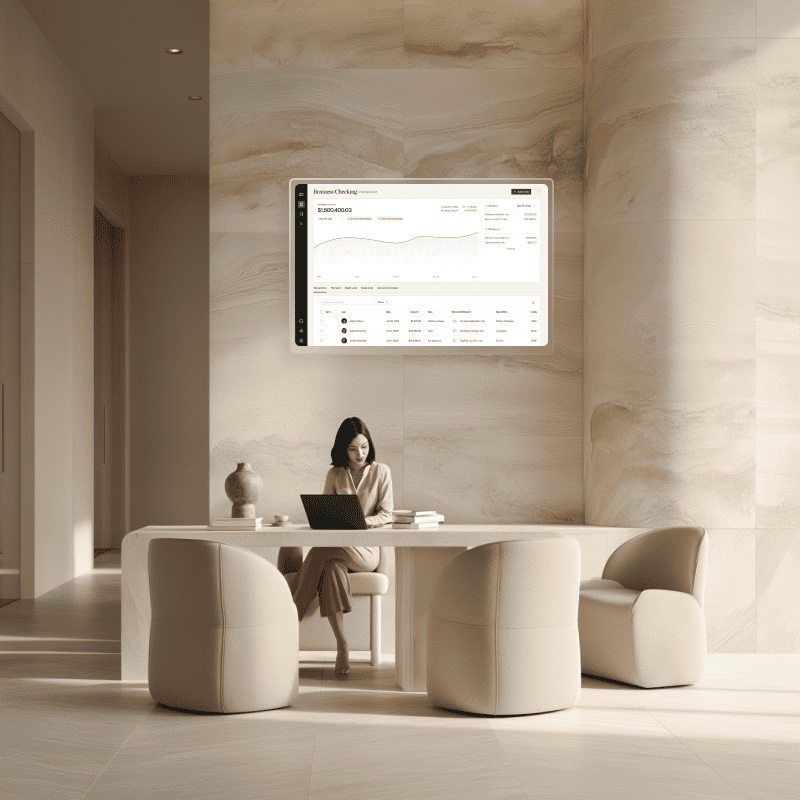

Gain Real-Time Visibility Into Cash Flow

Accounts payable AI will collect, analyze, and forecast your financial data. Based on information like outstanding receivables and payables, seasonality, and sales cycles, AI can predict your cash flow position and present it to you on a report or dashboard.

What to Look for in an AI AP Automation Platform

If you want to replace your current AP solution with one that is powered by AI, here are a few features to look for:

- OCR to read documents and extract

- Auto-categorization of transactions

- Smart approval routing

- Real-time reporting and notifications

You’ll want any AP system to include features like flexible payment methods (ACH, wires, checks) and integration with the other finance tools you use. However, in addition to those, you’ll want to look for the features above to ensure you’re getting robust accounts payable AI tools for your finance team.

Flex: AI-Powered AP Built for Scale

With Flex, you can automate your bill pay and expense management with free AP automation and powerful AI tools.

Flex offers built-in vendor and invoice management to Flex bank account holders. Flex’s AI Bill Pay will recognize and process invoice data, and you can create workflows to simplify approvals.

You can choose to pay via same-day ACH, send a no-fee wire transfer, or pay by credit card (earning rewards on eligible bill payments).

Flex Bill Pay will connect with accounting platforms like QuickBooks Online and is unified with your Flex credit and banking accounts.

Nick Sharma, Founder of Sharma Brands, says, “What truly sets Flex apart is how it streamlines your financial experience, seamlessly consolidating both your banking and credit needs into one powerful platform.”

Ready to Automate Your AP Process?

Companies will struggle with scale if they continue to rely on manual AP processes. AI and automation can reduce or eliminate tedious tasks, while also improving accuracy.

With Flex you can automate AP without adding another software subscription. Flexible payment options, combined with Flex banking and credit card products, can improve your cash flow.

.svg)