We Just Made History: Introducing the Flex Visa Infinite® Business Card

The following article is offered for informational purposes only, and is not intended to provide, and should not be relied on, for legal or financial advice. Please consult your own legal or accounting advisors if you have questions on this topic.

At Flex, we’ve always believed that modern business owners deserve more than a traditional card. They deserve tools that actually match the ambition, speed, and complexity of running a growing company today.

That’s why today, I’m proud to share a major milestone: Flex is the first U.S. fintech to launch a Visa Infinite® Business Credit Card.

This isn’t just a logo swap or an upgrade for the sake of flash. It’s a complete reimagining of what a business card can be and who it’s built for.

Why This Matters

Visa Infinite has long been the domain of elite corporate programs reserved for enterprise businesses, not entrepreneurs. But that’s exactly the kind of status quo we’re here to break.

By bringing Visa’s highest commercial tier to the Flex platform, we’re giving our customers access to a level of financial power and sophistication that simply hasn’t existed in the fintech space until now.

We’re not handing out another metal card. We’re delivering a full-stack financial advantage, one that starts with flexible capital and extends to luxury travel, purchase protection, and concierge-level support. This is what it looks like when you put world-class infrastructure behind world-class business owners.

What's New with the Flex Visa Infinite Business Credit Card?

With the new Flex Visa Infinite Business Credit Card, we’re not just matching legacy benefits — we’re surpassing them, and integrating them into a single platform built for modern operators.

Here’s what our cardholders now receive:

- Priority restaurant access via OpenTable

- Unlimited global airport lounge access with Priority Pass

- Luxury hotel perks including upgrades and on-property credits

- 24/7 Visa Infinite Concierge support from anywhere in the world

- Premium travel protections, including trip cancellation, lost luggage, and primary rental car coverage

- Robust purchase protections, extended warranties, and return coverage

And it all comes without annual fees, spend caps, or restrictive categories.

Smarter Rewards, Built for Business

Every Flex card comes with up to 60 days of interest-free terms¹, and now cardholders can choose how they want to benefit:

- Maximize cash flow with extended float

- Earn up to 1.75% unlimited cashback² for early payment

- Or earn 1.75x points² redeemable for travel³, gift cards³, or statement credits

No games. No gimmicks. Just flexibility, on your terms.

A Financial Platform, Not Just a Product

This card is not a standalone product. It’s one part of a fully integrated financial ecosystem:

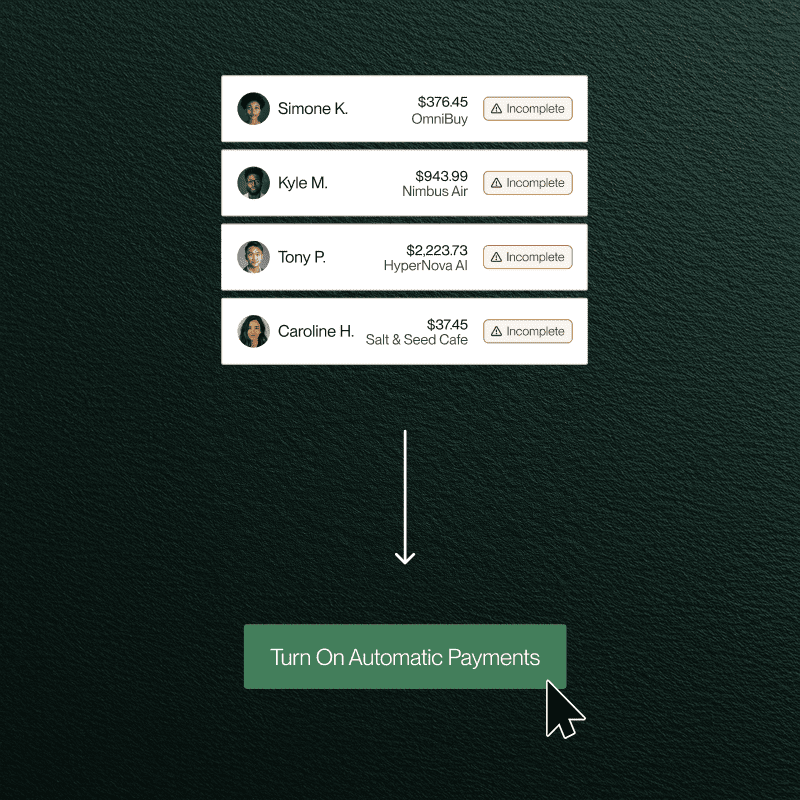

- Automated bill pay

- Built-in employee expense management

- High-yield business banking (up to 2.99% APY)*

- Cash flow analytics

- Real-time controls

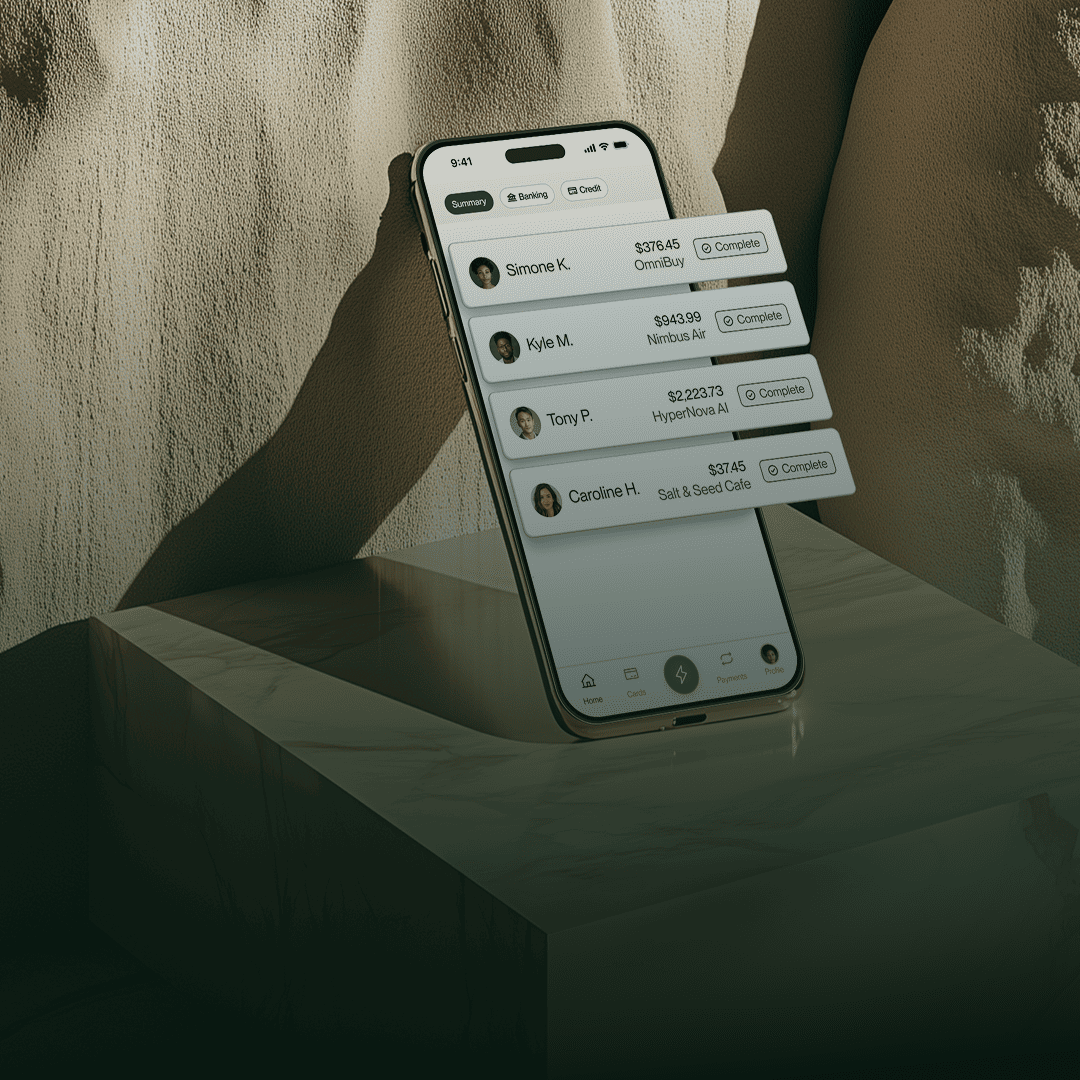

- Mobile apps for scaling teams

We’ve designed the Flex financial platform to remove friction, create visibility, and put business owners back in control of their finances. And now, with Visa Infinite, we’ve raised the ceiling even higher.

A New Standard for Business Finance

This launch is more than a product milestone, it’s a statement of intent. Flex is here to redefine the financial experience for business owners at every stage, from early momentum to hyper-growth.

We’re building the financial infrastructure that founders, operators, and visionaries need.

To every customer who’s trusted us, grown with us, and built alongside us: thank you. This is just the beginning.

Flexbase Technologies, Inc. (Flex) is a financial technology company and is not a bank.

Banking services provided by Thread Bank; Member FDIC. The Flexbase Technologies, Inc. Visa® Debit Card is issued by Thread Bank, Member FDIC pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

The Flex Business Credit Card is issued by Lead Bank, pursuant to a license from Visa U.S.A. Inc. and is only available to eligible commercial entities. Fees and terms and conditions apply. Applicants are subject to eligibility requirements.

¹0% interest applies if the full balance is paid within the 60-75 day interest-free grace period. Interest will begin to accrue if the full balance is not paid by the end of the current bi-monthly billing period following the 60-75 day interest-free grace period.

²Rewards points may be redeemed for cash back. See the Flex Rewards Program T&Cs for more details.

³Coming soon.

*Annual Percentage Yield (APY) of up to 2.99% for Tier 3 accounts and up to 1.65% APY for Tier 2 accounts is accurate as of 12/19/2024. These are variable rates based on the effective range of the Federal Funds Rate and may change after the account is opened. An average daily Account balance that is greater than $1,000,000 for at least thirty (30) days is required to be eligible to earn 2.99% APY and an average daily Account balance that is greater than $100,000 for at least thirty (30) days is required to be eligible to earn 1.65% APY.

_-Definition%2C-Formula%2C-%26-Examples.jpeg)

_-Definition%2C-Formula%2C-%26-Examples.jpeg)

.png)

.png)

.svg)