Operating Expenses (OpEx): Definition, Formula, & Examples

The following article is offered for informational purposes only, and is not intended to provide, and should not be relied on, for legal or financial advice. Please consult your own legal or accounting advisors if you have questions on this topic.

Running a business involves more than just selling products or services — it requires spending money to keep things running smoothly day-to-day. These everyday costs are known as operating expenses, or OpEx. Understanding what they are, how to calculate them, and how they impact your financial health is essential for budgeting, forecasting, and making strategic decisions.

In this guide, we’ll cover what operating expenses are, walk through the OpEx formula, and provide real-world examples to help you spot, manage, and optimize these costs.

What Are Operating Expenses?

Operating expenses are the ongoing costs required to run a business’ core operations. These costs are not directly tied to producing a specific product or service (like raw materials or labor), but they are critical to keeping the business functioning.

In short, operating expenses include anything a business spends money on that isn't capitalized (such as buying equipment) or classified as cost of goods sold (COGS).

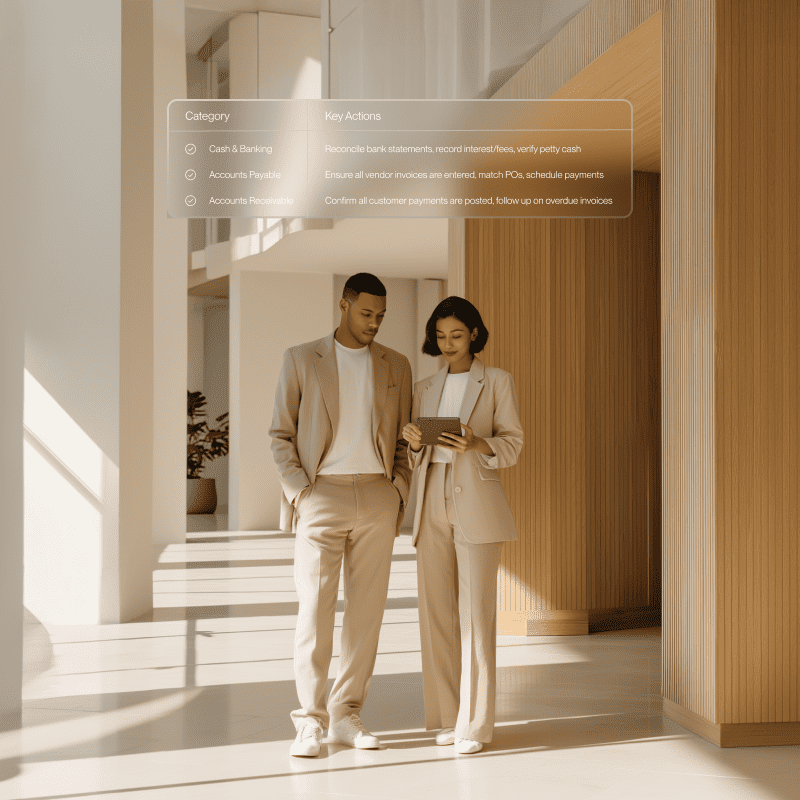

Common Types of Operating Expenses

Here are some typical examples of operating expenses:

- Rent or lease payments for office or retail space

- Utilities like electricity, water, and internet

- Salaries and wages for administrative and support staff

- Marketing and advertising costs

- Software subscriptions and tech tools

- Office supplies like computers and paper

- Insurance premiums

- Travel and entertainment for employees

- Maintenance and repairs

These costs are typically listed on a company’s income statement and are deducted from revenue to determine operating profit.

Operating Expenses vs. Non-Operating Expenses

To get a full picture of your financials, it’s important to distinguish operating expenditures from non-operating ones.

- Operating expenses (OpEx) relate to the company’s core business activities.

- Non-operating expenses are one-off or irregular costs unrelated to day-to-day operations, like interest payments, losses from asset sales, or restructuring costs.

This distinction matters when analyzing business performance because it isolates operational efficiency from outside variables.

The Operating Expense Formula

There’s no single “opportunity cost formula” for OpEx, but the general operating expense formula is straightforward:

Alternatively, if you have access to itemized expense data, you can sum up all OpEx categories:

Where OpEx Fits Into Financial Reporting

Operating expenses are used to calculate operating income, which is a measure of profitability from core business activities:

Understanding this relationship is key when calculating opportunity cost. If OpEx is too high, your operating income — and ability to invest in growth — may suffer.

Real-World Examples of Operating Expenses

To give you a clearer idea of how OpEx works in practice, here’s a breakdown of what operating expenses could look like for two different types of businesses:

By categorizing your expenses, you can better understand which areas are driving costs and where there may be room to optimize.

Why Tracking Operating Expenses Matters

Keeping a close eye on your operating expenditures can help you make smarter, data-driven decisions. Here’s why it matters:

- Profitability insight: Reducing unnecessary OpEx can boost your bottom line.

- Forecasting accuracy: Tracking recurring expenses helps you budget more effectively.

- Cash flow control: Predictable OpEx gives you better visibility into your available funds.

- Investor transparency: Clean, well-categorized expenses reflect well in financial reports.

How to Manage and Reduce Operating Expenses

You don’t always need to slash budgets to improve efficiency. Here are practical strategies to keep OpEx in check:

- Automate workflows: Use tools to streamline billing, payroll, and reporting.

- Negotiate vendor contracts: Reevaluate software subscriptions, leases, and service providers.

- Outsource strategically: Consider contractors or fractional staff for specialized roles.

- Align spend to performance: Prioritize spending that supports growth, sales, or customer retention.

- Review OpEx regularly: Conduct monthly audits to track trends and flag anomalies.

Final Thoughts

Understanding your operating expenses is key to running a financially sound business. From utilities and wages to software and insurance, these costs power your day-to-day operations and directly impact your profitability.

Now that you know what OpEx is, how to calculate it, and how it shows up in different industries, you can confidently manage your expenses to support long-term growth. Whether you're optimizing current spending or forecasting future needs, a strong grip on OpEx will help you stay agile, efficient, and competitive.

_-Definition%2C-Formula%2C-%26-Examples.jpeg)

.png)

.png)

.png)

.svg)